GFPB INITIATIVE OFFERS LOW-INCOME RESIDENTS 30-YEAR, 100% MORTGAGE FINANCING

Who are ALICE Families?

ALICE households are everyday individuals and families who earn more than the Federal Poverty Level but still fall short of meeting the essential cost of living. These are people who work one or more jobs, contribute to the economy, and pay taxes, yet face financial challenges as the cost of living continues to outpace their earnings.

The Challenge in Pine Bluff

Pine Bluff has seen a significant decline in homeownership rates, dropping from 66% in 2013 to just 53.4% in 2018, well below the national average of 63.9%. Many ALICE families are burdened with high rental costs, often exceeding what they would pay for a mortgage, leading to substandard living conditions. Improving homeownership among these families is crucial for their economic and social mobility.

Our Collaborative Response

In response to these challenges, a coalition including the City of Pine Bluff, Simmons Bank, and Go Forward Pine Bluff, among others, has been formed. This coalition is committed to increasing homeownership, establishing neighborhood associations, incentivizing development, and ultimately enhancing property values in Pine Bluff.

Homeownership and Development Initiatives

97% Affordable Advantage

100% Advantage Home Mortgage Products

Pine Bluff Homeowners’ Association (PBHOA)

Neighborhood Enhancement Act

Simmons Bank’s Mortgage Products

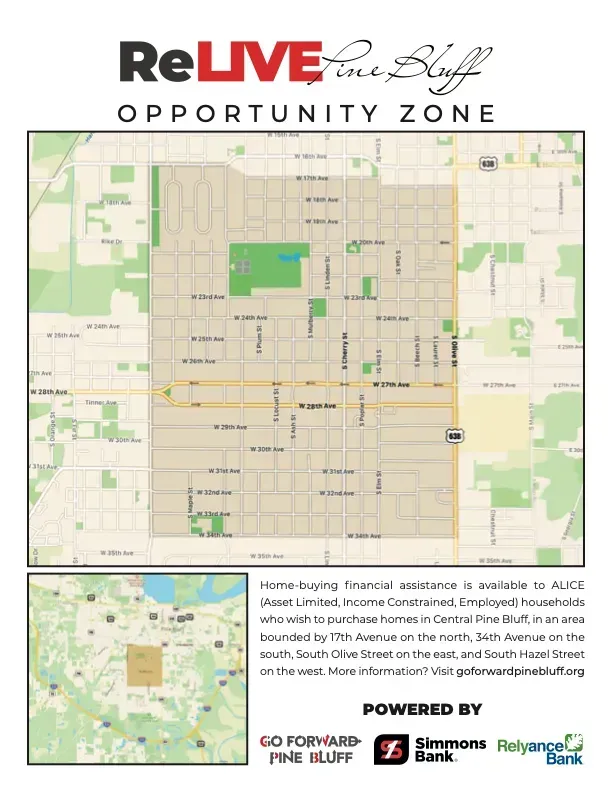

Simmons Bank, in collaboration with Go Forward Pine Bluff, has introduced the 97% Affordable Advantage and 100% Advantage Home Mortgage Products. These products aim to make homeownership more accessible by lowering qualifying credit scores to 580 and 620, respectively. These mortgages come with specific income and geographic restrictions.

Pine Bluff Homeowners’ Association (PBHOA)

The PBHOA offers secondary loans for closing cost assistance and mortgage down payments, covering up to 3% of the mortgage cost. To qualify, recipients must agree to join the PBHOA.

Neighborhood Enhancement Act

To attract developers to specific areas of Pine Bluff, the Neighborhood Enhancement Act provides up to 20% of new construction or rehabilitation costs. Homeowners benefiting from this act must commit to living in the designated area for at least five years.

Homeownership and Development Initiatives

97% Affordable Advantage

100% Advantage Home Mortgage Products

Pine Bluff Homeowners’ Association (PBHOA)

Neighborhood Enhancement Act

Simmons Bank’s Mortgage Products

Simmons Bank, in collaboration with Go Forward Pine Bluff, has introduced the 97% Affordable Advantage and 100% Advantage Home Mortgage Products. These products aim to make homeownership more accessible by lowering qualifying credit scores to 580 and 620, respectively. These mortgages come with specific income and geographic restrictions.

Pine Bluff Homeowners’ Association (PBHOA)

The PBHOA offers secondary loans for closing cost assistance and mortgage down payments, covering up to 3% of the mortgage cost. To qualify, recipients must agree to join the PBHOA.

Neighborhood Enhancement Act

To attract developers to specific areas of Pine Bluff, the Neighborhood Enhancement Act provides up to 20% of new construction or rehabilitation costs. Homeowners benefiting from this act must commit to living in the designated area for at least five years.

Get Involved

If you are an ALICE family or know someone who could benefit from these programs, or if you are a developer interested in contributing to the revitalization of Pine Bluff, please reach out to us. Together, we can help Pine Bluff families achieve the dream of homeownership and strengthen our community.

Alice Application

Please send the following items to the PBHOA for review/approval prior to setting a closing date.

Provide the closing agent/title company - Contact Information (Phone #)

PBHOA Notice to Homebuyer

Inspection of the Home

Loan Estimate Form/Closing Disclosure

Commitment Letter from Mortgage

Real Estate Contract (executed copy)

Birth Certificate (if applicable)

Appraisal

Homebuyer Counseling Certificate (HUD-approved homebuyer counselor)

2022 All Rights Reserved.