Promises Made, Promises Kept.

Stay up-to-date with

Go Forward Pine Bluff News

Stay up-to-date with

Go Forward Pine Bluff News

Looking For More Information?

Check Out GFPB News Below

More About

Go Forward Pine Bluff

Frequently Asked Questions

What is GFPB?

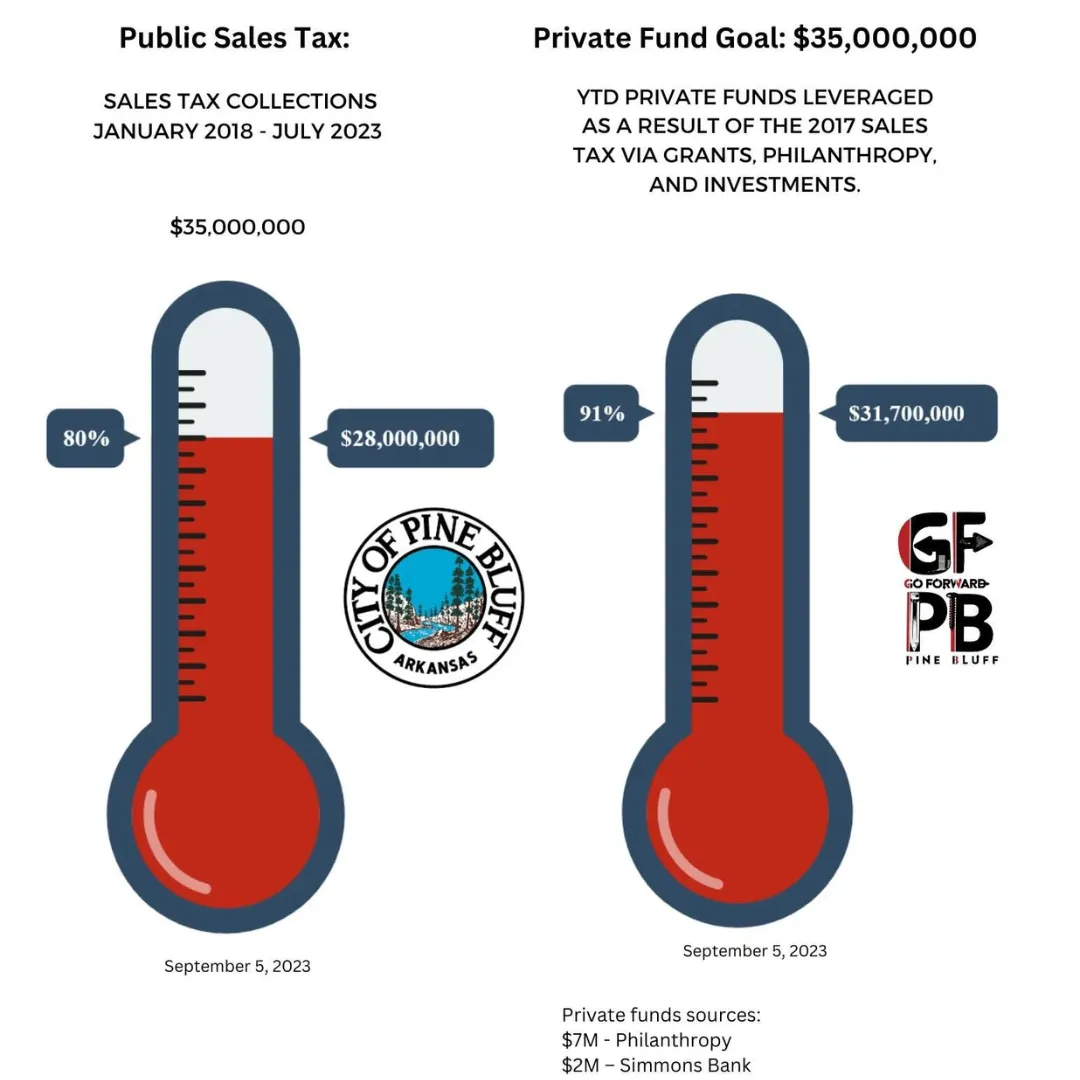

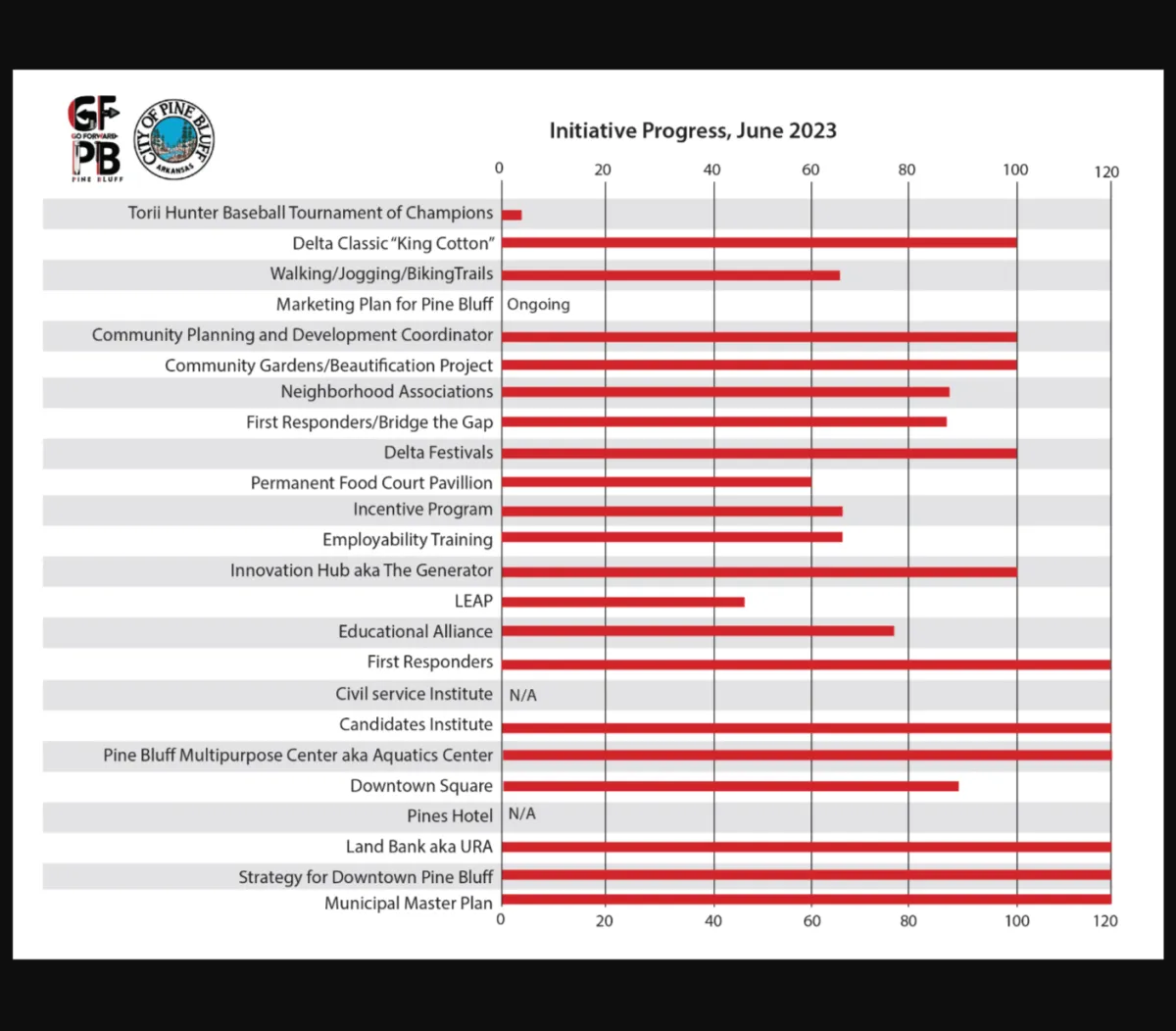

Go Forward Pine Bluff (GFPB) started as a grassroots effort of a group of 100 diverse volunteers–age,race, gender, economic stature-who spent 2016 developing a strategic plan to grow the tax base of our community based on four pillars: Economic Development, Education, Government and Infrastructure, and Quality of Life. The GFPB Plan is funded by a 7-year 5/8th cent sales tax that was passed overwhelmingly by 70% of the voters, business investments, private donations, and grants. A public- private partnership was formed with the City of Pine Bluff to ensure the funding is utilized appropriately to implement the 27 initiatives in the Plan. GFPB seeks to increase the revenues of the city, retain population, relocate population, and attract tourism and consumers. Our goal is to establish the necessary working relationships to move Pine Bluff forward.

What does GFPB do?

Go Forward Pine Bluff works to advance economic development, government infrastructure, quality of life, and public education in Pine Bluff, Arkansas. Our mission is to increase the revenues of the city and improve municipal services.

I need help with my business?

The Generator is an innovation hub powered by GFPB. Here we provide a number of resources, including facilitating access to capital.

Does GFPB give Grants?

GFPB makes private contributions to education institutions. We also partner with other organizations to provide seed monies for small business development.

How can GFPB help me buy a home?

In partnership with the business sector, Simmons and Relyance Banks, The GFPB initiative offers lowincome residents 30-year, 100% mortgage financing through the ALICE program.

For more information or details on the application process contact Owen Mouser at [email protected],870.663.0200.

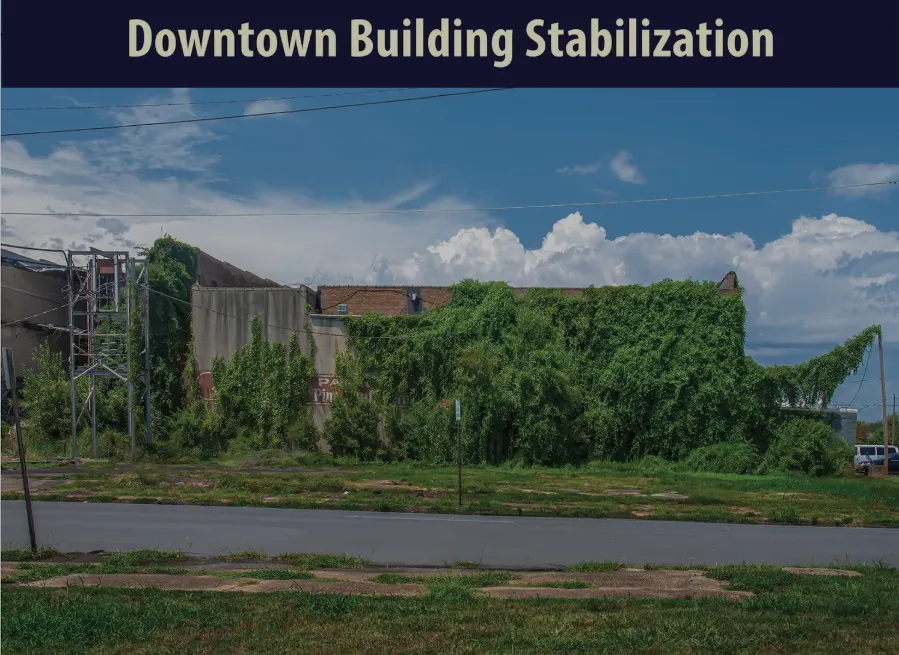

How can I contact Urban Renewal and Code Enforcement?

City of Pine Bluff Code Enforcement

Director: Patrick Lockett

200 EAST 8TH AVENUE, STE 103

PINE BLUFF, AR 71601

M-F 8:00am-5:00pm

Tel: 870.730.2021

Fax: 870.730.2152

Pine Bluff Urban Renewal Agency

Director: Chandra

417 W 6th Ave

Pine Bluff, AR 71601

PINE BLUFF, AR 71601

M-F 8:00am-5:00pm

(870) 209-0323

How can I request receipts and invoices?

Complete a Freedom of Information Request Form through the Pine Bluff City Clerk’s Office located at 200 East 8th Avenue in Pine Bluff, Arkansas.

Telephone: (870) 730-2006

Who can I contact to submit my idea for a new project?

If you have an idea that would improve economic development, government infrastructure, quality of life, or public education and would like to partner with GFPB, please contact our office at 870-663-0200

What projects are pending and when will they be complete?

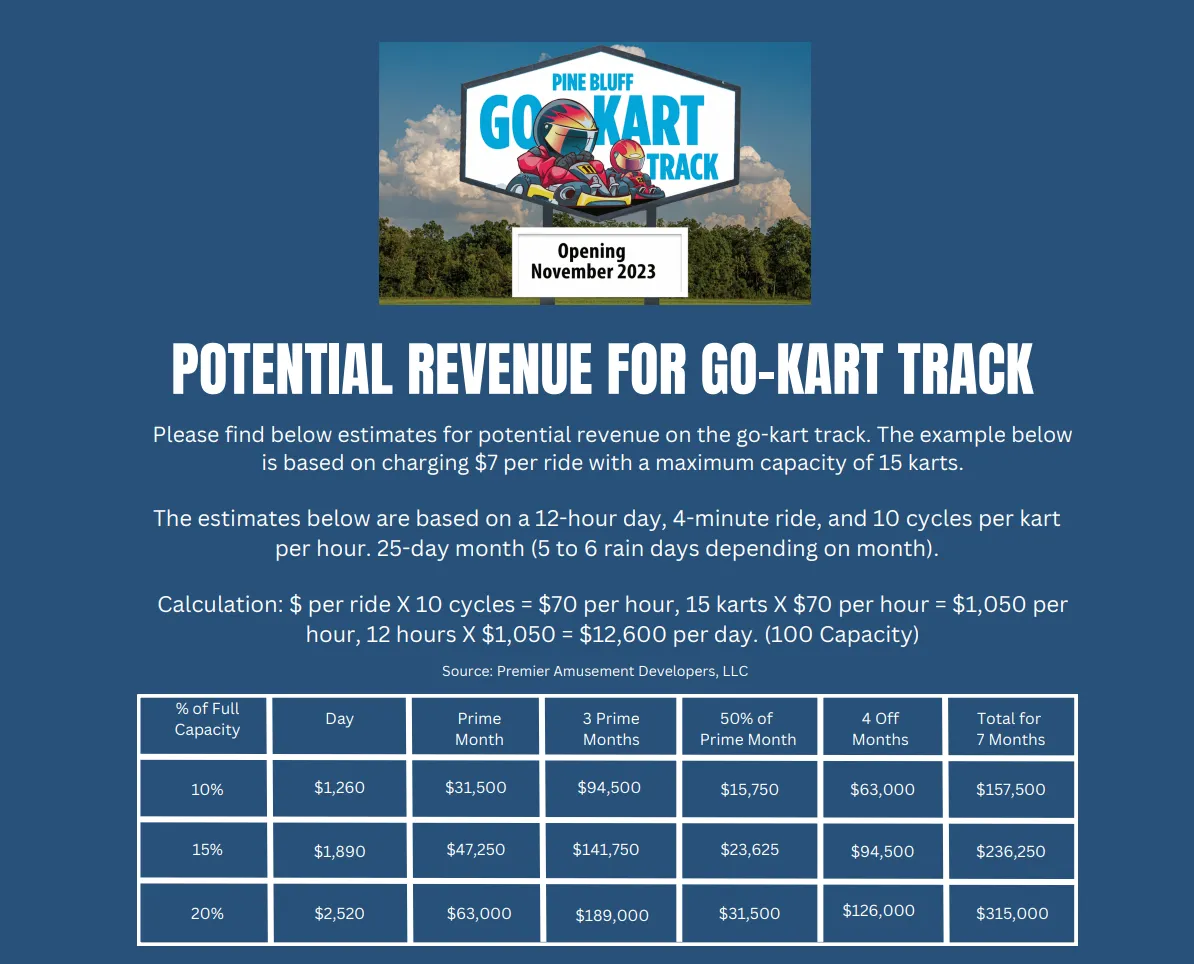

Go-Kart Track - Spring 2025

6th & Main - September 2025

Convention Center Hotel - 2026

Multi-Family Apartment Housing - 3rd Quarter of 2025

Does GFPB have control of the tax money?

Per Arkansas State Statute, non-governmental entities such as GFPB can have no authority regarding taxpayer money. All expenditures must be approved by the City Council.

2022 All Rights Reserved.